Company Story

1936 - Allied Inc. was founded by Harold L. Simmons as a small trading company in Chicago.

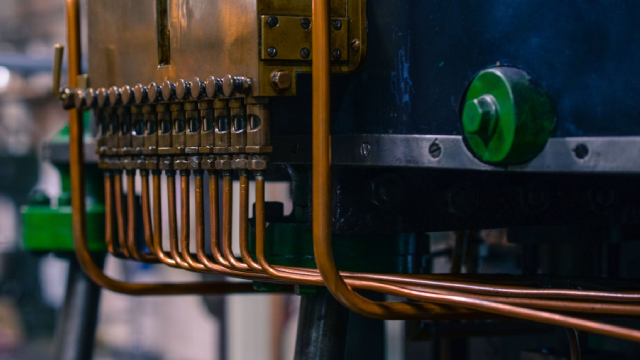

1940s - The company expanded its operations to include scrap metal recycling and trading.

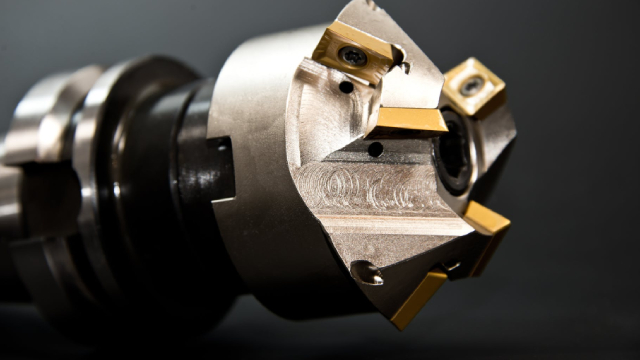

1950s - Allied Inc. began to focus on the steel industry, providing raw materials to steel mills.

1960s - The company went public with an initial public offering (IPO).

1970s - Allied Inc. expanded its operations internationally, opening offices in Europe and Asia.

1980s - The company diversified its business, entering the energy and real estate markets.

1990s - Allied Inc. acquired several companies, expanding its presence in the steel and energy industries.

2000s - The company continued to grow through acquisitions and strategic partnerships.

2010s - Allied Inc. focused on sustainability and environmental initiatives, investing in renewable energy sources.