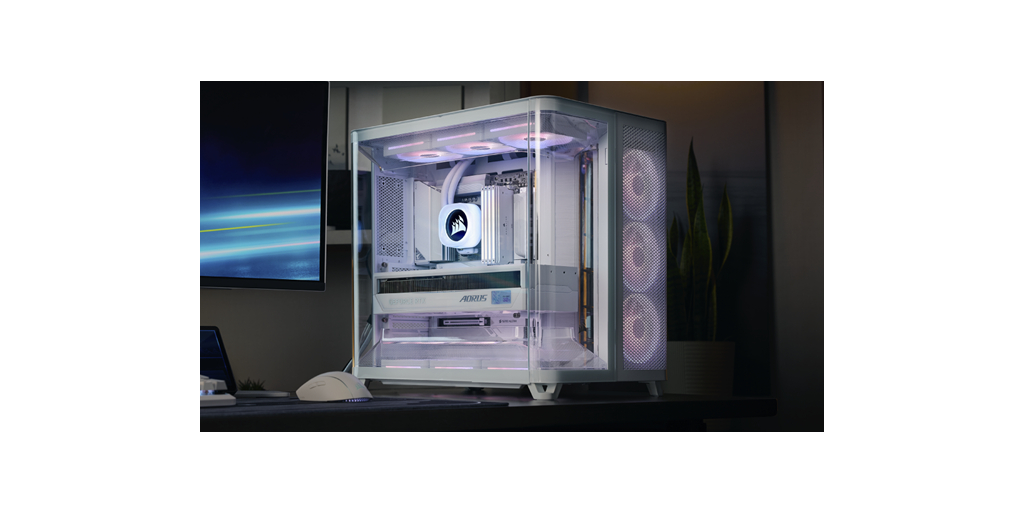

Company Story

1994 - Corsair Memory was founded by Don Lieberman, Tom Wicklund, and John Beekley.

1998 - Corsair introduced its first DDR SDRAM memory modules.

2002 - Corsair launched its first high-performance DDR memory modules, the XMS.

2006 - Corsair entered the CPU cooling market with the launch of its Nautilus GPU cooler.

2008 - Corsair introduced its first power supply units (PSUs), the HX Series.

2011 - Corsair acquired Simple Audio, a Scottish company specializing in audio products.

2014 - Corsair launched its first gaming keyboard, the K95 RGB.

2015 - Corsair acquired Elgato, a German company specializing in gaming peripherals.

2018 - Corsair acquired Origin PC, a US-based custom gaming PC manufacturer.

2020 - Corsair went public with an initial public offering (IPO) on the NASDAQ stock exchange.