Company Story

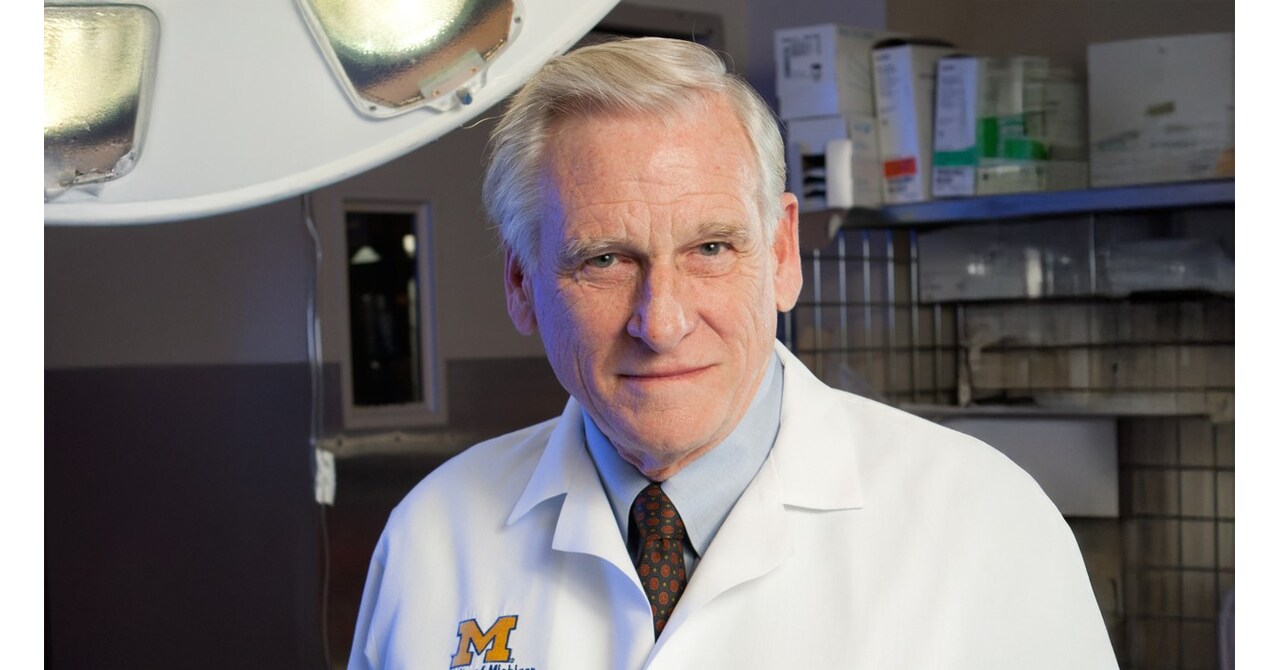

1997 - Cytosorbents Corporation founded by Dr. Phillip Chan

2002 - First prototype of CytoSorb developed

2008 - CytoSorb receives CE Mark approval in the European Union

2011 - Cytosorbents Corporation goes public with an initial public offering (IPO)

2013 - CytoSorb receives FDA approval for use in cardiac surgery

2015 - Cytosorbents Corporation launches CytoSorb in the United States

2018 - CytoSorb receives FDA Breakthrough Device designation for use in sepsis

2020 - Cytosorbents Corporation announces partnership with Fresenius Medical Care