Company Story

1910 - Enerpac Tool Group Corp. was founded as Hydraulic Power Company in Milwaukee, Wisconsin, USA.

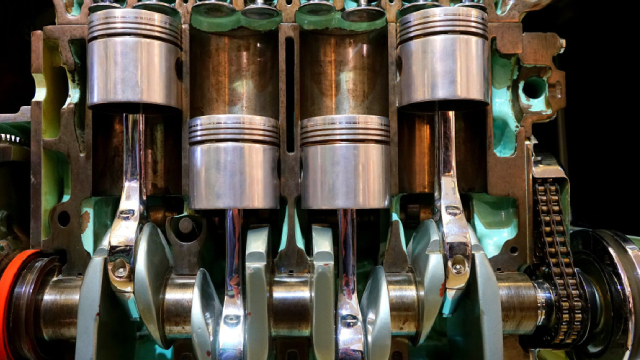

1920 - The company introduced its first hydraulic jack, which was designed for the automotive industry.

1950 - Enerpac developed the first hydraulic cylinder, which was used in the construction industry.

1960 - The company went public with an initial public offering (IPO) of stock.

1970 - Enerpac expanded its product line to include hydraulic pumps, valves, and other accessories.

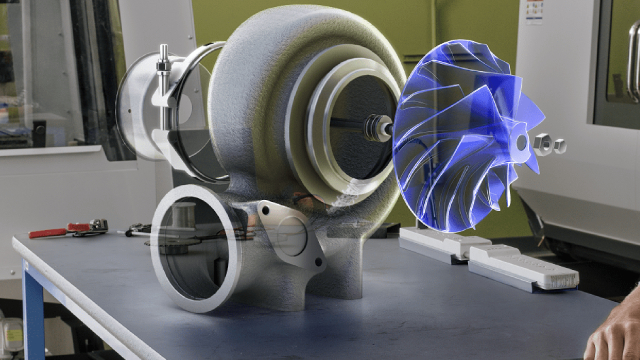

1980 - The company introduced its first electric hydraulic pump, which was designed for industrial applications.

1990 - Enerpac acquired several companies, expanding its product line and global presence.

2000 - The company launched its first battery-powered hydraulic pump, designed for remote applications.

2010 - Enerpac introduced its first hydraulic system for the wind energy industry.

2015 - The company launched its first IoT-enabled hydraulic system, designed for industrial automation.