Company Story

1993 - KLA Instruments was founded by Stanley T. Ogi and Robert E. Swasey

1997 - KLA Instruments acquired several companies, including Therma-Wave, Inc., and Optical Associates, Inc.

2000 - KLA Instruments merged with Tencor, Inc. to form KLA-Tencor Corporation

2001 - KLA-Tencor Corporation acquired the metrology and inspection business of Hitachi High-Technologies Corporation

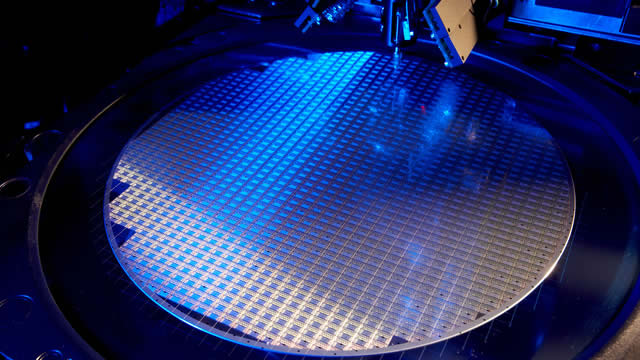

2007 - KLA-Tencor Corporation launched its first extreme ultraviolet (EUV) lithography reticle inspection system

2010 - KLA-Tencor Corporation acquired the Process Control and Metrology business of Vistec Technology GmbH

2012 - KLA-Tencor Corporation launched its WaferGuard 3D inspection system

2015 - KLA-Tencor Corporation acquired the metrology business of Carl Zeiss SMT GmbH

2019 - KLA-Tencor Corporation changed its name to KLA Corporation

2020 - KLA Corporation acquired the portfolio of process control and metrology products from the Hermes Microvision, Inc.