- Valuation Driven by Turnaround Potential, Not Current Fundamentals: Intel trades at 3.5× forward sales and 67× forward P/E, reflecting optimism around its foundry transformation rather than current profitability. Current valuations assume partial success in its strategic pivot but are still below peers like AMD and Nvidia.

- Strategic Investments Validate Foundry Ambitions: The U.S. government, Nvidia, and SoftBank have collectively invested $12.7B in Intel, signaling confidence in its 18A manufacturing node and future foundry capabilities. This funding is critical for capital-intensive projects and validates Intel’s path to competing with TSMC.

- Critical Catalyst: Panther Lake Launch in Q1 2026: The successful launch of Panther Lake processors on the 18A node in late January 2026 will be a pivotal test of Intel’s manufacturing progress. Strong performance and yield rates (>60%) could catalyze a re-rating of the stock toward growth multiples.

- Execution-Dependent Price Targets: Analysts project a base-case 12-month price range of $38–$48, with upside to $50–$60 if 18A proves competitive and external foundry wins accelerate. A bear case of $25–$30 hinges on yield failures or continued CPU share losses to AMD.

- Cautious Analyst Sentiment and Binary Outcomes: Wall Street remains split, with a "Hold" consensus and wide price target dispersion ($18–$52). The stock’s near-term direction hinges on operational proof points (e.g., 18A yields, margin expansion) rather than financial metrics, making it a high-risk, high-reward "execution story."

Intel Corporation (INTC) Valuation & Price Target Analysis

Intel's valuation and price target analysis as of January 2026 explores the company's market position, strategic investments, and potential outcomes across base, bull, and bear scenarios. The analysis highlights Intel's transition from a struggling semiconductor giant to a potential foundry leader, with significant execution risks and opportunities.

Author: Analystock.ai

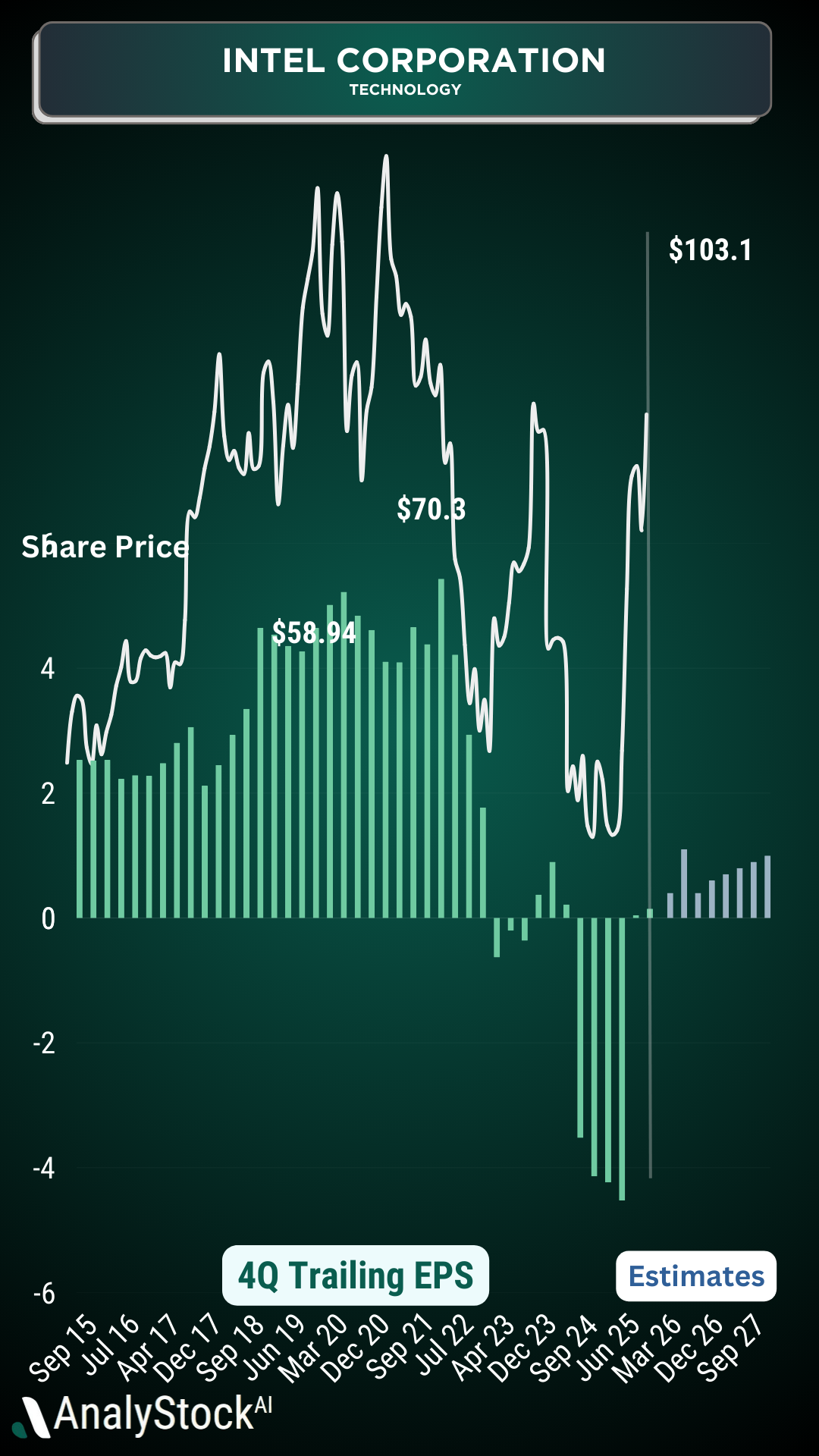

Current Valuation (January 2026)

Intel's market capitalization stands at approximately $190 billion (around $40 per share), reflecting a 83% year-to-date rebound from 2024 lows. Valuation multiples show Intel trading at 3.5× trailing sales (vs. AMD's 8-9× and Nvidia's 25-30×), with an extremely elevated forward P/E of 67× due to depressed near-term profitability. Revenue growth in Q3 2025 was 3% YoY ($13.7 billion), with Q4 guidance at $12.8-$13.8 billion. Gross margins have declined to 40% (from historical mid-60s), but adjusted free cash flow of $900 million in Q3 signals operational improvement. Strategic investments totaling $12.7 billion from the U.S. government, Nvidia, and SoftBank validate Intel's foundry roadmap and provide capital for its $18 billion 2025 CAPEX plans.

Base Case (12-Month View Through January 2027)

A base-case scenario projects $55-57 billion in 2026 revenue (mid-to-high single-digit growth) with gross margins improving to 42-43%. Non-GAAP EPS could reach $0.80-$1.00, supporting a $28-40 stock price at 35-40× forward P/E. Optimistic execution—such as 18A node yields exceeding 60% and external foundry wins—could push the stock to $54-75 (45-50× forward 2027 earnings). Conversely, execution delays or yield issues might compress valuation to $25-30, aligning with traditional semiconductor multiples.

Bull Case (3-5+ Years Through 2029-2030)

In a bullish scenario, Intel becomes a credible foundry alternative to TSMC by 2030. With 10-15% foundry market share ($30-45 billion revenue) and CPU business stabilization ($30-35 billion), total revenue could reach $75-90 billion. Gross margins might recover to 50-55%, with operating margins at 20-25%. At 20-25× earnings, this supports a $60-100 stock price. A more aggressive scenario—mimicking TSMC's valuation—could justify $120-140 per share (30-35× $20 billion in net income). Key enablers include Panther Lake performance, 14A node customer wins, and sustained U.S. government support.

Bear Case

A pessimistic outcome sees Intel's foundry ambitions failing due to 18A yield issues (<60%) and TSMC's dominance. CPU market share losses to AMD could reduce revenue to $25-28 billion by 2030, with gross margins stuck at 38-42%. Net income might peak at $5-7 billion, leading to a $12-22 stock price (12-15× earnings). A moderate bear case—partial foundry success—yields $25-35 (15-18× earnings). Risks include yield problems, TSMC's technological lead, and capital intensity consuming cash flow.

Comparables and Relative Valuation

Intel's valuation sits between 2× (2024 trough) and 5-8× (successful peers). TSMC trades at 20-25× earnings with 20-25% revenue growth, while AMD is at 35× forward earnings. Intel's 67× forward P/E reflects optimism about its 2027-2028 potential but creates execution risk. The strategic 'domestic foundry' premium—due to U.S. government support—adds intangible value, though it's hard to quantify.

Price Target Summary

- 12-Month: $38-48 (base), $50-60 (bull), $25-30 (bear).

- 3-Year: $50-90 (reasonable execution), $30-40 (weak execution).

- Long-Term: $60-140 (bull), $12-25 (bear).

Analyst Consensus and Market Sentiment

Wall Street analysts maintain a 'Hold' rating with an average price target of $33-39. The wide dispersion ($18-52) reflects binary outcomes: Melius Research upgraded to 'Buy' ($50 target) citing 18A progress, while Wedbush and Bank of America remain bearish ($20-34 targets). Institutional ownership is mixed, with value investors betting on government support and growth funds underweighting Intel. Retail investors view it as a 'turnaround of the decade' story.

Key Catalysts and Risks for 2026

Positive Catalysts:

- Panther Lake reviews and 18A yield data.

- 14A node external customer announcements.

- Nvidia partnership progress.

- Margin expansion to 45%+.

- CPU market share stabilization.

- CHIPS Act policy support.

- 18A yield problems.

- Failure to secure 14A customers.

- AMD's CPU dominance.

- Margin compression.

- Cash burn from CAPEX.

- Macro/geopolitical headwinds.

Conclusion

Intel's valuation reflects a mid-transformation status—neither a legacy decline nor a proven turnaround. The next 12-18 months will determine if it becomes a foundry superpower or a cautionary tale. Investors should monitor technical execution (18A yields, Panther Lake performance) and strategic progress (external customer wins). The stock offers asymmetric upside but requires careful sizing due to its high execution risk profile.