Company Story

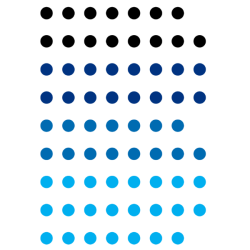

2000 - MakeMyTrip Limited was founded by Deep Kalra.

2002 - MakeMyTrip launched its travel portal, marking its entry into the online travel space.

2005 - MakeMyTrip raised its first round of funding from SAIF Partners.

2007 - MakeMyTrip expanded its operations to the US, with the launch of its US-based subsidiary.

2010 - MakeMyTrip went public with an initial public offering (IPO) on NASDAQ.

2011 - MakeMyTrip acquired Luxury Resorts, a Thailand-based hotel chain.

2012 - MakeMyTrip acquired Hotel Travel Group, a Thailand-based hotel aggregator.

2015 - MakeMyTrip acquired MyGola, a travel planning website.

2016 - MakeMyTrip acquired Ibibo Group, a leading online travel company in India.

2017 - MakeMyTrip Limited merged with Ibibo Group to create India's largest travel company.

2019 - MakeMyTrip Limited acquired a majority stake in Quest2Travel, a corporate travel company.