Company Story

1931 - Baxter International Inc. was founded by Donald E. Baxter as a manufacturer of medical equipment.

1933 - The company developed the first commercially available intravenous solution, known as Baxter-Vac.

1941 - Baxter began manufacturing penicillin, becoming one of the first companies to do so.

1954 - The company went public with an initial public offering (IPO).

1956 - Baxter introduced the first disposable medical device, a plastic syringe.

1961 - The company expanded internationally, establishing operations in Europe.

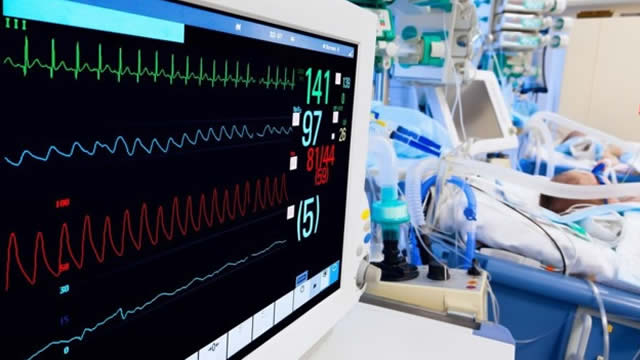

1971 - Baxter developed the first artificial kidney, known as the Baxter 400.

1983 - The company acquired American Hospital Supply Corporation, expanding its product line.

1991 - Baxter spun off its hospital supply business, creating a new company called Allegiance Corporation.

2004 - The company acquired Gambro AB, a Swedish medical technology company.

2015 - Baxter spun off its biopharmaceuticals business, creating a new company called Baxalta Incorporated.

2016 - The company acquired Claris Lifesciences, an Indian pharmaceutical company.