Company Story

1923 - West Pharmaceutical Services, Inc. was founded by Herman O. West

1955 - West Pharmaceutical Services, Inc. went public with an initial public offering (IPO)

1964 - West Pharmaceutical Services, Inc. began trading on the New York Stock Exchange (NYSE) under the ticker symbol WST

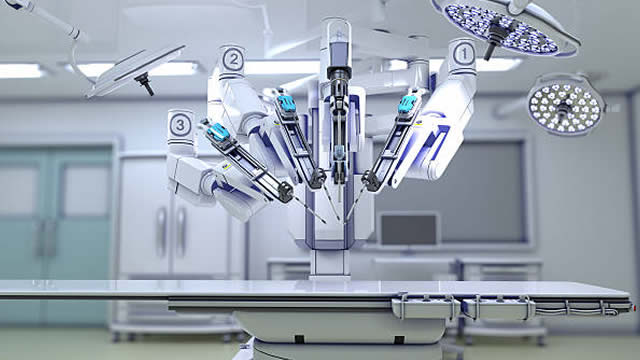

1980s - West Pharmaceutical Services, Inc. expanded its product line to include pharmaceutical packaging components and medical devices

1990s - West Pharmaceutical Services, Inc. began to expand globally, establishing operations in Europe and Asia

2000s - West Pharmaceutical Services, Inc. made several strategic acquisitions to expand its product offerings and capabilities

2010s - West Pharmaceutical Services, Inc. continued to expand globally, establishing operations in Latin America and the Middle East