Company Story

2010 - CareDx, Inc. founded by Dr. Pierrick Rollet and Dr. Paul Terasaki

2011 - Company raises $1.5 million in Series A funding

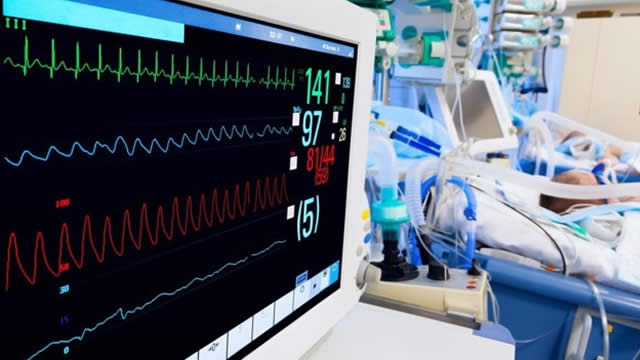

2012 - CareDx launches AlloMap, a non-invasive test for heart transplant rejection

2013 - Company raises $20 million in Series C funding

2014 - CareDx receives FDA clearance for AlloMap

2016 - Company raises $40 million in Series D funding

2018 - CareDx goes public with an initial public offering (IPO)

2019 - Company launches AlloSeq, a transplant rejection test for kidney and heart transplants

2020 - CareDx acquires OTTR, a transplant patient tracking platform