Company Story

1988 - MiMedx Group, Inc. was founded by Parker H. Petit, a renowned entrepreneur and inventor.

1990 - The company developed its first product, a wound care device called the 'WoundMatrix'.

1995 - MiMedx Group, Inc. went public with an initial public offering (IPO).

2001 - The company acquired the assets of BioMimetic Therapeutics, Inc., expanding its product portfolio.

2003 - MiMedx Group, Inc. launched its flagship product, EpiFix, a dehydrated human amnion/chorion membrane allograft.

2011 - The company acquired the assets of Stability Biologics, LLC, further expanding its product offerings.

2013 - MiMedx Group, Inc. acquired the assets of OrthoDx, LLC, a leading provider of orthopedic and spine allografts.

2015 - The company launched its AmnioFix product line, a series of dehydrated human amnion/chorion membrane allografts.

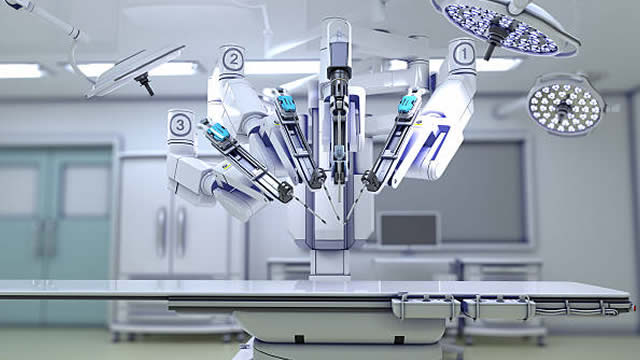

2018 - MiMedx Group, Inc. was acquired by Misonix, Inc., a leading provider of minimally invasive surgical ultrasonic dissection devices.