Company Story

1997 - Monolithic Power Systems, Inc. was founded by Michael Hsing and James M. C. Wang.

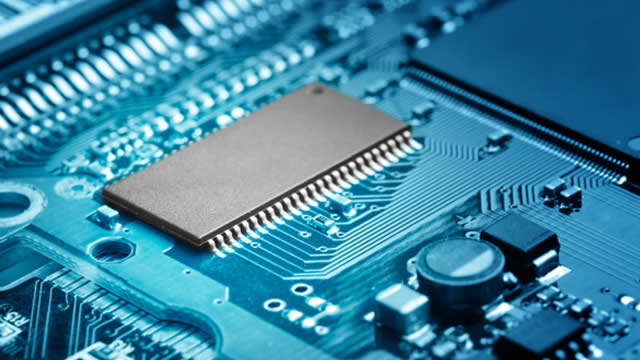

1998 - The company started developing its first product line of voltage regulators.

2001 - MPS went public with an initial public offering (IPO) of 3 million shares.

2004 - The company started shipping its first DC-DC converter products.

2007 - MPS acquired certain assets of Integrated Power Corporation.

2011 - The company started shipping its first LED driver products.

2014 - MPS acquired Sensitron Semiconductor.

2017 - The company started shipping its first automotive-grade products.

2020 - MPS acquired APM Semiconductor.