Company Story

1996 - NETGEAR, Inc. was founded by Patrick Lo

1997 - Introduced the company's first product, the DG814 ADSL modem

1999 - Went public with an initial public offering (IPO)

2000 - Introduced the company's first wireless router, the ME102

2003 - Acquired Infrant Technologies, a provider of network attached storage (NAS) solutions

2007 - Introduced the company's first NAS product, the ReadyNAS

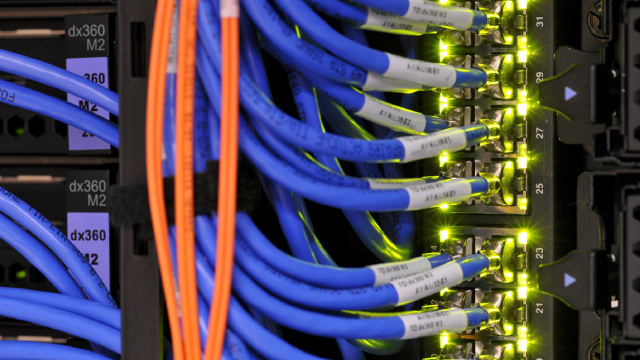

2010 - Acquired Sierra Wireless's AirCard business, expanding into the mobile broadband market

2013 - Introduced the company's first 802.11ac wireless router, the R6300

2016 - Acquired Platina Systems, a provider of network management and monitoring solutions