Company Story

1827 - The company's earliest predecessor, the Erie Railroad, is chartered.

1853 - The Richmond and Danville Railroad is chartered.

1880 - The Southern Railway is formed through the consolidation of several railroads.

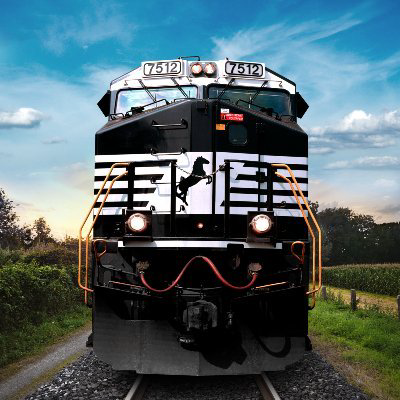

1980 - The Norfolk and Western Railway and the Southern Railway merge to form the Norfolk Southern Corporation.

1999 - Norfolk Southern acquires 58% of the Consolidated Rail Corporation (Conrail).

2000 - Norfolk Southern acquires the remaining 42% of Conrail.

2015 - Norfolk Southern rejects a takeover bid from Canadian Pacific Railway.

2021 - Norfolk Southern announces a new operating plan, TOP21, to improve efficiency and reduce costs.