Company Story

1987 - OraSure Technologies, Inc. was founded by Michael G. Zrelak and Ronald H. Spair

1994 - The company went public with an initial public offering (IPO)

1995 - OraSure introduced the first rapid HIV test, the OraQuick HIV-1/2 Antibody Test

2003 - The company received FDA approval for the OraQuick In-Home HIV Test

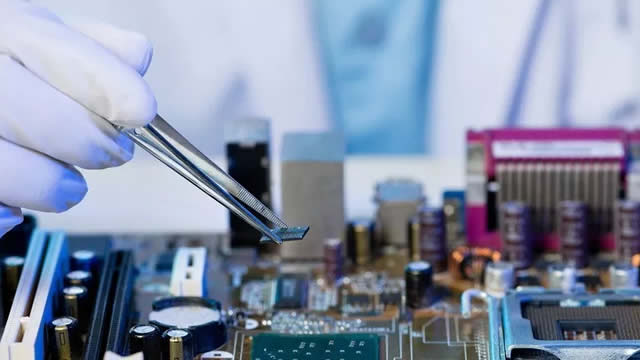

2004 - OraSure acquired the assets of STC Technologies, expanding its molecular diagnostic capabilities

2012 - The company launched the OraQuick HCV Rapid Antibody Test for hepatitis C

2015 - OraSure acquired the assets of DNA Genotek, a leading provider of oral fluid sample collection devices

2017 - The company launched the OraQuick Ebola Rapid Antigen Test, the first rapid diagnostic test for Ebola

2020 - OraSure received FDA Emergency Use Authorization for its SARS-CoV-2 antigen rapid test