Company Story

1897 - Becton, Dickinson and Company founded by Maxwell Becton and Fairleigh Dickinson

1906 - Company incorporated and begins manufacturing syringes

1920s - BD introduces its first hypodermic needle and begins exporting products

1940s - Company develops and manufactures medical devices for the US military during World War II

1950s - BD introduces its first disposable syringe and begins expanding globally

1962 - Company goes public with an initial public offering (IPO)

1980s - BD introduces its first HIV blood-testing system and begins acquiring other companies

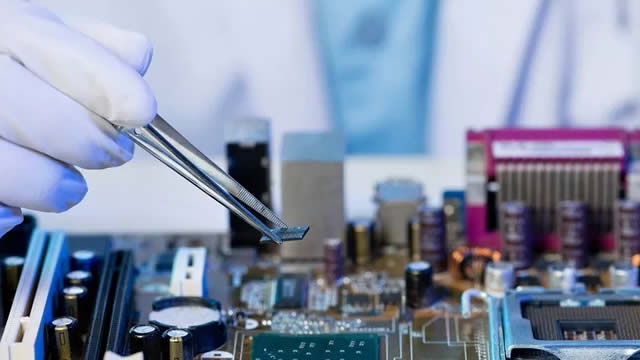

1990s - Company expands into the biotechnology and molecular diagnostics markets

2000s - BD introduces its first safety-engineered syringe and begins acquiring companies in the medical technology space

2015 - Company acquires CareFusion, expanding its presence in the medical technology market