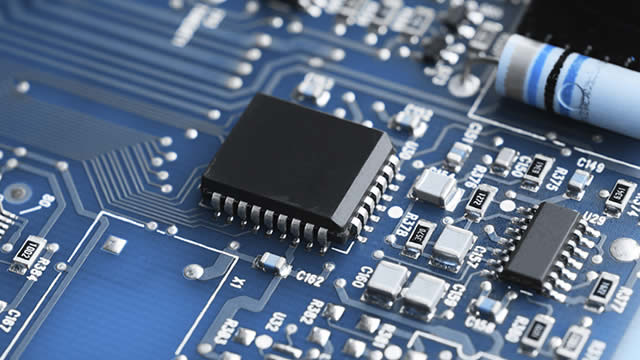

Company Story

1977 - Aehr Test Systems was founded by Rhea J. Eden and R. Livingston

1980 - Introduced the first wafer-level test system, the WLT-100

1983 - Introduced the first test system for semiconductor memory devices, the MTX-100

1990 - Introduced the first test system for advanced semiconductor devices, the FOX-1

1995 - Completed initial public offering (IPO) and listed on the NASDAQ stock exchange

2000 - Introduced the FOX-XP, a high-speed test system for advanced semiconductor devices

2004 - Introduced the ABTS, a test system for advanced burn-in and test services

2010 - Introduced the FOX-NP, a test system for advanced semiconductor devices

2015 - Introduced the FOX-XP2, a high-speed test system for advanced semiconductor devices