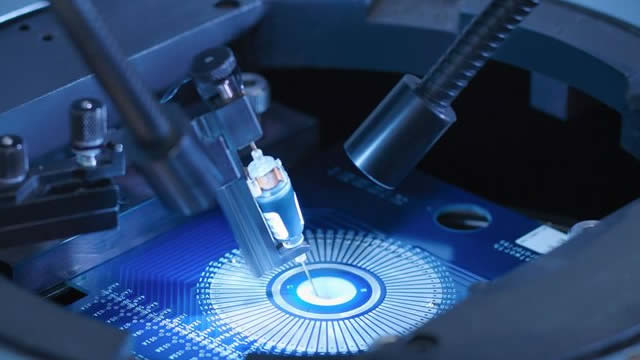

Company Story

1987 - Arteris, Inc. founded by Charlie Janac as a semiconductor IP company

1992 - First product, AHB, released, a on-chip interconnect IP for SoC designers

1997 - Arteris introduces FlexNoC, a network-on-chip (NoC) interconnect IP

2007 - Arteris raises $11 million in Series A funding from venture capital firms

2012 - Arteris introduces Ncore, a cache coherent interconnect IP for heterogeneous systems

2016 - Arteris raises $44 million in Series D funding to accelerate growth

2019 - Arteris introduces AI-enabled network-on-chip (NoC) interconnect IP

2020 - Arteris goes public with an initial public offering (IPO) on the Nasdaq stock exchange