Company Story

1879 - The company that would eventually become Chevron was founded on August 5th as Pacific Coast Oil Company.

1882 - The company was renamed Standard Oil of California.

1901 - The discovery of the El Segundo Oil Field in California significantly increased the company's oil production.

1911 - The Standard Oil Trust was dissolved, and the company became Chevron Oil Company of California.

1920 - The company began to expand its operations into the Midwestern United States.

1984 - The company officially changed its name to Chevron Corporation.

2001 - Chevron merged with Texaco to form ChevronTexaco.

2005 - The company dropped 'Texaco' from its name and reverted to Chevron Corporation.

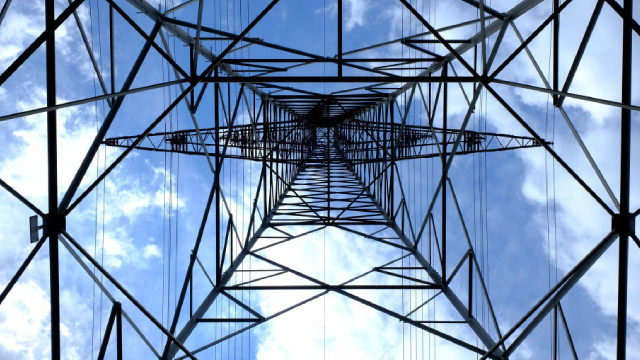

2010 - Chevron made a significant natural gas discovery in the Marcellus Shale in Pennsylvania.

2020 - Chevron announced its plans to acquire Noble Energy in a deal worth $5 billion.