Company Story

1859 - Equitable Life Insurance Company of Iowa founded

1992 - Demutualization and IPO

2004 - Acquired by AXA

2016 - Spin-off from AXA and rebranding as Equitable Holdings, Inc.

2020 - IPO and listing on the New York Stock Exchange

Equitable Holdings, Inc., together with its consolidated subsidiaries, operates as a diversified financial services company worldwide.The company operates through four segments: Individual Retirement, Group Retirement, Investment Management and Research, and Protection Solutions.The Individual Retirement segment offers a suite of variable annuity products primarily to affluent and high net worth individuals.

Equitable Holdings reported full-year non-GAAP operating earnings of $5.64 per share, or $6.21 per share after adjusting for notable items, up 1% from 2024. The actual EPS came out at $1.76, beating estimates of $1.75. Assets under management and administration reached a record $1.1 trillion, up 10% year-over-year, driven by strong sales growth in Retirement and Wealth Management.

Publication Date: Feb -16

The Retirement segment saw net flows of $5.9 billion, a 4% organic growth rate, driven by record RILA sales, which grew 12% year-over-year. Wealth Management experienced net inflows of $8.4 billion, a 13% organic growth rate, with the number of productive wealth planners increasing by 12%. AllianceBernstein saw net outflows of $11.3 billion but reported strong momentum in its private markets business, which grew AUM by 18% to $82 billion.

Equitable Holdings' adjusted book value per share ex AOCI and with AB at market value was $33.84. The company's Price-to-Book Ratio stands at -181.88, indicating potential undervaluation. With expected mid- to high single-digit growth in pretax earnings in Retirement and double-digit growth in Wealth Management, the company's growth prospects appear robust. Analysts estimate next year's revenue growth at 7.6%.

The company returned $1.8 billion to shareholders in 2025, including $500 million of additional share repurchases executed after a life reinsurance transaction with RGA. The Dividend Yield stands at 2.37%, providing a relatively stable source of return for investors. Equitable expects to grow cash flows 10% in 2026, driven by higher asset and wealth earnings and larger expected retirement dividends.

The company addressed concerns over its private credit portfolio, noting that it makes up 16% of its total GA, with 50% in corporate private placements. The direct lending portion is only 1% of the total GA, mitigating potential risks. Equitable feels confident about the quality of its private credit portfolio, with only 3% of companies having elevated risk ratings on its watch list.

Equitable remains on track to meet its 2027 targets, including $2 billion of cash, a 60-70% payout ratio, and 12-15% EPS CAGR. The guidance given probably gets the company to the lower end of the EPS CAGR range, but it still has levers, such as expenses, to reach this range. With a strong balance sheet and increasing organic cash generation, Equitable is well-positioned to return capital to shareholders while investing for growth.

Illinois Municipal Retirement Fund Grows Stock Position in Equitable Holdings, Inc. $EQH

Feb -14

Caisse Des Depots ET Consignations Has $3.67 Million Stock Position in Equitable Holdings, Inc. $EQH

Feb -12

Equitable Holdings Announces Additional $1 Billion Share Repurchase Authorization and Declares Common and Preferred Stock Dividends

Feb -11

Truist Financial Corp Purchases 21,127 Shares of Equitable Holdings, Inc. $EQH

Feb -08

Equitable Holdings, Inc. (EQH) Q4 2025 Earnings Call Transcript

Feb -05

Compared to Estimates, Equitable Holdings (EQH) Q4 Earnings: A Look at Key Metrics

Feb -05

Equitable Holdings, Inc. (EQH) Q4 Earnings Beat Estimates

Feb -05

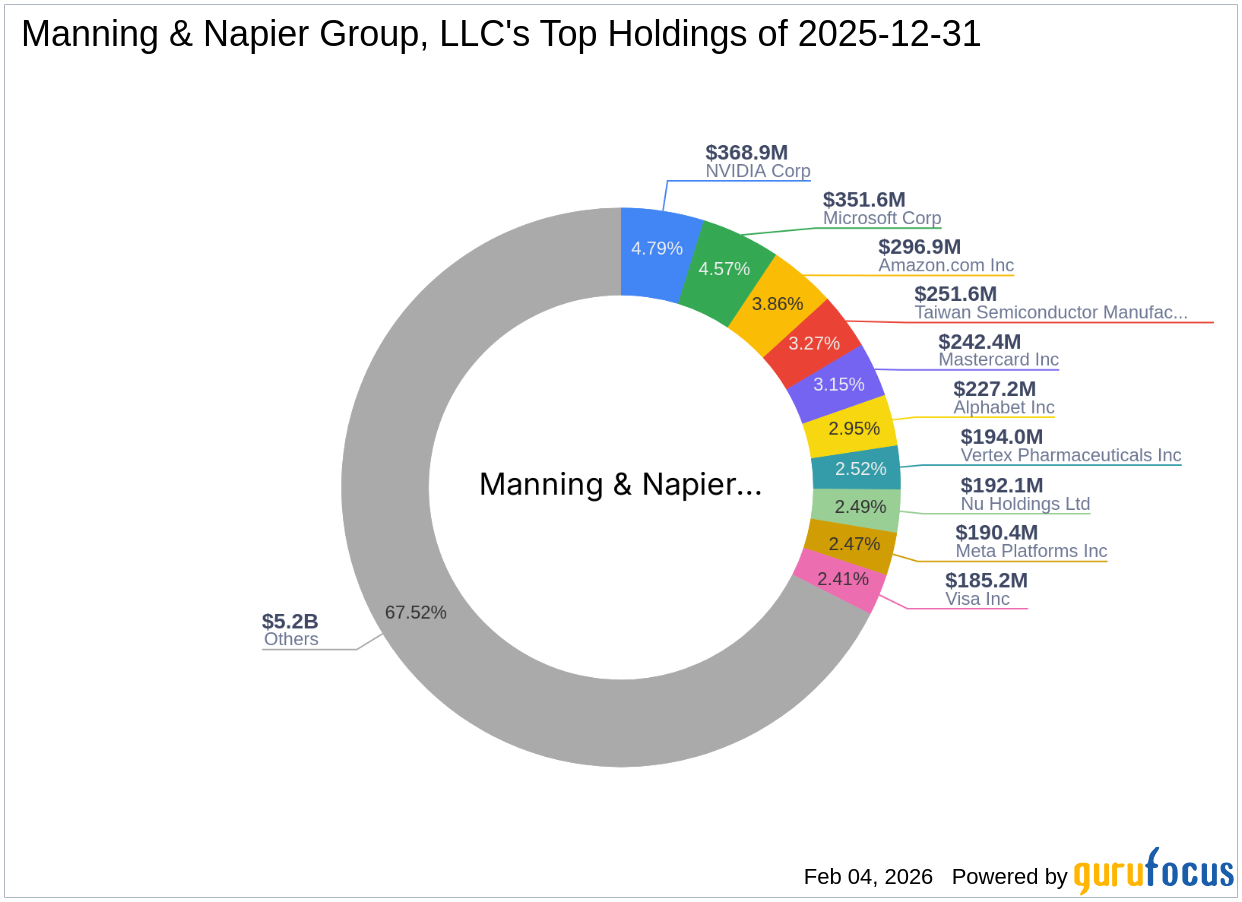

Manning & Napier Group, LLC Reduces Stake in UnitedHealth Group Inc by 65.05%

Feb -04

Equitable Holdings, Inc.'s 9.76% growth in Investment Management and Research is driven by increasing demand for diversified investment products, expansion of distribution channels, and strategic partnerships. Additionally, the company's focus on digital transformation, cost savings initiatives, and strong brand recognition have contributed to its growth momentum.

Equitable Holdings' Protection Solutions segment growth of 5.4% is driven by increasing demand for life insurance and annuity products, expansion into new distribution channels, and strategic partnerships. Additionally, the company's focus on digital transformation and customer-centric approach have improved sales and retention rates, contributing to the segment's growth.

The 5.4% growth driven by Adjustments from Equitable Holdings, Inc. is attributed to increased premiums, favorable mortality experience, and expense management. Additionally, the company's strategic investments in digital transformation and expansion into new markets have contributed to the growth. Furthermore, the company's efforts to improve operational efficiency and reduce costs have also had a positive impact.

Equitable Holdings, Inc.'s Individual Retirement segment growth of 6.37% is driven by increasing demand for retirement savings products, expansion of distribution channels, and strategic partnerships. Additionally, the company's focus on digital transformation, competitive pricing, and product innovation have contributed to the growth. Furthermore, the rising popularity of fee-based advisory services and the growing need for retirement income solutions have also supported the segment's growth.

Wealth Management from Equitable Holdings, Inc. achieved 8.23% growth driven by increasing demand for retirement planning, expansion of fee-based advisory services, and strategic acquisitions. Additionally, the segment benefited from a rise in assets under management, fueled by market appreciation and net inflows. These factors, combined with effective cost management, contributed to the segment's robust growth.

Equitable Holdings, Inc.'s Corporate and Other segment growth of 7.4% is driven by strategic investments in digital transformation, expansion of alternative investment channels, and cost savings initiatives. Additionally, the segment benefits from a low interest rate environment, driving demand for retirement savings products and increasing fee-based revenue streams.

Equitable Holdings' Group Retirement segment growth of 5.4% is driven by increasing demand for retirement plans, expansion of distribution channels, and strategic partnerships. Additionally, the segment benefits from a strong brand presence, competitive pricing, and a growing need for employers to offer retirement benefits to attract and retain talent.

The 5.45% growth in Eliminations from Equitable Holdings, Inc. is driven by increased demand for insurance products, expansion into new markets, and strategic acquisitions. Additionally, the company's focus on digital transformation and cost savings initiatives have contributed to improved operational efficiency, further boosting growth.

Legacy from Equitable Holdings, Inc. with 4.83% growth driven by strong brand recognition, diversified product offerings, and a large distribution network. Additionally, the company's focus on digital transformation, cost savings initiatives, and strategic acquisitions have contributed to its growth momentum.

A type of permanent life insurance that allows policyholders to invest their cash value in various investments.

A type of life insurance that provides coverage for a specified period of time (e.g., 10, 20, or 30 years).

A type of permanent life insurance that combines a death benefit with a savings component.

A type of universal life insurance that earns interest based on the performance of a specific stock market index.

A type of annuity that provides a fixed rate of return for a specified period of time.

A type of annuity that allows policyholders to invest their funds in various investments.

A type of savings plan designed to help individuals save for retirement.

The threat of substitutes for Equitable Holdings, Inc. is medium due to the presence of alternative financial services and products offered by competitors.

The bargaining power of customers for Equitable Holdings, Inc. is low due to the company's strong brand reputation and diversified product offerings.

The bargaining power of suppliers for Equitable Holdings, Inc. is medium due to the company's dependence on a few key suppliers for certain products and services.

The threat of new entrants for Equitable Holdings, Inc. is high due to the relatively low barriers to entry in the financial services industry and the increasing trend of fintech startups.

The intensity of rivalry for Equitable Holdings, Inc. is high due to the highly competitive nature of the financial services industry and the presence of established players.

| Value | |

|---|---|

| Debt Weight | 60.60% |

| Debt Cost | 3.95% |

| Equity Weight | 39.40% |

| Equity Cost | 10.91% |

| WACC | 6.69% |

| Leverage | 153.79% |

Value: 6.7

Growth: 4.9

Quality: 7.0

Yield: 10.0

Momentum: 8.0

Volatility: 9.7

1-Year Total Return ->

Value: 7.2

Growth: 5.4

Quality: 6.7

Yield: 8.0

Momentum: 6.0

Volatility: 8.7

1-Year Total Return ->

Value: 8.2

Growth: 4.3

Quality: 7.8

Yield: 8.0

Momentum: 5.0

Volatility: 6.0

1-Year Total Return ->

Value: 4.9

Growth: 7.6

Quality: 8.1

Yield: 5.0

Momentum: 5.0

Volatility: 7.0

1-Year Total Return ->

Value: 4.7

Growth: 7.0

Quality: 6.2

Yield: 5.0

Momentum: 4.0

Volatility: 8.3

1-Year Total Return ->

Value: 5.4

Growth: 7.8

Quality: 3.6

Yield: 4.0

Momentum: 5.0

Volatility: 7.0

1-Year Total Return ->